ZenGo Case Study:

BOV Conviction Model of Investment enables team to "keep the offense on the field"

Welcome to the Benson Oak Ventures newsletter. If you haven’t subscribed, click below to join and get regular updates about our views on B2C, Digital SMB and PassionWare and the new wave of Israeli start-ups aiming to build global brands.

This article was a joy to write, a case study of one of our first investments - ZenGo - and the power of the BOV conviction model at work.

ZenGo is executing on a mission to become the preferred crypto finance hub for the masses with its easy to use, super secure all-in-one wallet.

Led by Founders Ouriel Ohayon (CEO directly responsible for Marketing and Product, among other), Omer Shlomovits (Cryptography) and Tal Be'ery (Security and Engineering), the team simply executes - with a clear strategic vision, disciplined roadmap and devotion to excellence.

Background

BOV invested in ZenGo initially in August 2018, leading a $4M round with consortium of 10+ investors including Samsung Next, Elron and FJ Labs. As the investment was pre-product, the goals of the initial round were (i) to complete the first release of the product leveraging breakthrough MPC (Multi-Party Computation) technology as a new paradigm for security on a mobile wallet app and (ii) acquire early users and develop the brand.

At the time, Bitcoin was in the midst of its crypto winter period and in November 15 its market capitalization fell below $100 billion for the first time since October 2017 and the price fell to $5,500. Nevertheless, BOV and the consortium shared a conviction about the future utility of crypto and early belief in the team — however, high conviction in the team itself was soon to follow!

While the price of Bitcoin continued to fall - reaching a low of $3,400 at the time of ZenGo's private launch in January - the team simply focused on execution, launching publicly in June and getting rave customer support from early adopters.

Doubling Down

Benson Oak Ventures follows a "high-conviction" investment model whereby we take on early risk with investment capital and, combined with providing operational capital, double and triple down on the winners in the portfolio.

The Benson Oak Conviction Index helps provide an objective assessment to this approach, utilizing the prism of two main criteria: execution on agreed OKRs (objectives and key results) and the state of founder market fit.

In the case of ZenGo, founder market fit was clearly embodied in a team combining technologists, cryptography experts and a CEO with world-class consumer marketing and product capabilities. In the one year after initial investment, the Team focused on productization and development and deployed a beta version of iPhone app. Early on, ZenGo showed the promise in terms of user experience and customer love based on simple on-boarding requiring no key management burdens for users. Ouriel immediately leveraged his marketing network and "telling the story" capabilities and started to build the brand through multiple channels including leading features on podcasts. Tal, Omer and the entire R&D team gained ground on the technical side to capture early thought leadership as well as grants and other cooperation from leading global players. All the goals and objectives were achieved, highlighted by rave product reviews.

In August 2019, the BO Conviction Index for ZenGo was flashing green — not due to market conditions (Bitcoin was still at $9,000) but to the stronger conviction in the initial investment thesis that ZenGo could be the #1 crypto wallet for consumers - as it prepared for the launch of Android and full commercial activity in 2020. Buoyed by continued belief in the future of crypto, the conviction was engendered mainly by seeing the team in action and understanding up close their passion, drive for excellence and, most of all, execution capabilities.

Two months after launch and one year after initial investment, BOV thus decided to double-down and led a significant top-up round with great support from existing investors such as Samsung Next, Elron, Collider Ventures and a significant amount of new investors joined the cap table. The purpose of the top-up round was to leverage the early brand and traction to accelerate user growth and generate early revenue.

The ZenGo team also took the view to skip a big fund-raising tour and preferred a quick round supported by BOV as lead investor. Of major importance for both was the fact BOV and the ZenGo Founders have developed an excellent and symbiotic relationship on the vision and strategy. This made it a win-win for everyone for Benson Oak Ventures to lead the top-up round and enable ZenGo to focus on execution, and together we moved quickly to complete the round — in less than a month with new shareholders included.

Post-Funding: Keep the Offense on the Field

As it prepared to launch fully in 2020, ZenGo was on full offense. With the benefit of the rapid funding round, the team was able to "keep its offense on the field" and drive faster with full product offering and at the same time, to focus on growing brand, market traction and partnerships. From a starting point of zero, ZenGo surpassed $100M in processed transactions via the app in 2020 and with Bitcoin exploding, it is well poised to be the #1 crypto wallet in a market rapidly becoming mainstream.

From day one, the app has shined in terms of UX with easy on-boarding and frictionless key management, all wrapped in a delightful experience. ZenGo has had a consistent vision around the combination of security, convenience and delightful experience to provide all the basic features required for mass adoption and every day use. The vision also consistently revolved around an app for mass market consumers and the Team resisted numerous requests to license, brand, sub-brand or extend to corporate use - showing the oft-overlooked power of just saying no.

The DNA of the Founding Team encompasses this vision and thus has been reflected in the roadmap, supported by the underlying cutting-edge MPC technology which the team determined two years before its first funding was the only way to build such a wallet. The MPC technology enables the team to implement its vision — as it can add features quickly and integrate with the entire ZenGo experience, thereby undergirding the mission to be the top crypto wallet for the masses.

By August 2019, the team had accomplished much in short period of time but the app was only iPhone, supported just a few currencies and only wallet features were Send and Receive crypto. There was much to achieve in terms of commercial activity and roadmap and scaling the company, including hiring and building a 24/7 support team, which the team identified early as absolutely essential. By quickly raising the round without the usual time-suck as well as friction and due diligence required by new investors, Ouriel, Omer and Tal could "stay in their seats" and do what needed to be done, with the proceeds of the new round providing ample runway to hire and build.

Post-funding, the Founders and growing team (spurred also by new financing) took the ZenGo product activity into overdrive - supported in part by the benefit of time it was granted from the rapid funding round. ZenGo was able to deploy key roadmap items quickly coinciding with a marked increase in Bitcoin activity and price in Q1 2020:

Launch of Android early Q1 2020 (coincide with Q1 increase in user activity

Easy buying of crypto and swap into other currencies (a delightful experience, again coinciding with Bitcoin as well as altcoin bull run) and engendering significant revenue expansion

Portfolio tracking (also coinciding with Q1 Bitcoin run - you get the pattern!)

The onset of Covid killed the rally briefly, falling to a low of $4,400 but as we now see, the seeds had been planted as the rally came back with a vengeance by Q4 in part due to Covid-related concerns about global money printing as well as enhanced institutional involvement of large investors and key players like PayPal and Square. When the market took off, ZenGo was there and ready, supported by additional features including the recent launch of sell (crypto to fiat) - a similarly major step for the mainstream adoption (and one that was of course demanded by users as some profit-taking recently ensued).

Below is visual demonstration of the key product and operational milestones in context of the timing of funding, as well as parallel market cycles. As you can see, the period after the August top-up investment led by Benson Oak Ventures was marked by rapid release of key components.

By the time, the Bitcoin market went from 12K to 40K in just 3 months, ZenGo has released all of the key aspects inherent in a consumer crypto wallet.

The team also continued to execute on brand-building and multiple partnerships, such as milestone partnership signed with VISA (which will enable to ship a Payment Card, branded ZenGO) - this will enable users to spend and pay seamlessly for things in real world with their crypto, a major step in the original vision around mainstream adoption.

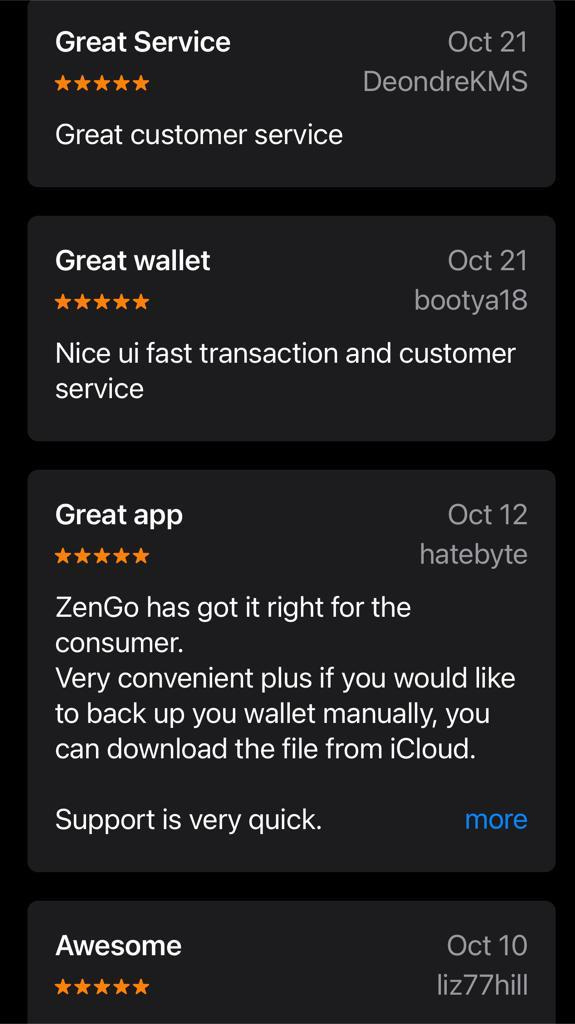

With the time to execute, the team built a world-class 24/7 support operation garnering 4.6 average rating and less than 2 minute support time - essential in building consumer wallet for the masses, especially in crypto.

The focus on customer happiness is part of the vision in appealing to mass market use and another example of the benefits of "keeping the team on the field" - the time spent by the team on building this customer support team in late 2019 would have been simply unavailable if fund-raising was the main priority.

ZenGo not only never had to play defense, but the team has had the luxury to keep its offense on the field with little break required for fund-raising.ZenGo has thus experienced enormous user and revenue growth alongside its product releases, achieving 20X user growth in 12 months!

This is the power of the conviction model at work: the company saved about 3 months from a traditional fund-raising process, in addition to the usual drain on energy and attention. By having the resources (and the management time!), they were able to deploy new product features quickly and have them in the app just as the market for Bitcoin rebounded. In a “traditional” method, they would have raised the funding required but with a major opportunity cost - a cost potentially exacerbated by missing the market timing when those exact features were in higher demand among new entrants. A classic example where firepower and time to market thus increased the company’s value.

Flywheel and Return on Luck

I love to reference Jim Collins books and in this case, two of his concepts standout —

As mass adoption looms on the horizon over the next few years, the ZenGo flywheel is well-poised to kick into gear:

Its MPC technology will unlock more potential features (simpler trading and swaps, superior safety features, advanced recovery, and much more) ——>

thereby enabling easy on-boarding for mass market consumers who want control of their crypto assets - easily and securely ——>

thereby adding to adoption and every day use of crypto by consumers as well as commercial activity of all types ——>

in turn spreading the word of mouth about ZenGo (viral effect), to be enhanced soon by features unlocked by MPC that will drive community effects ——>

and so on.....as ZenGo user base, brand and revenue all benefit from market adoption (external factor, also helped by a non-custodial app like ZenGo) as well as ZenGo's own brand and reach.

In their seminal book "Good to Great", Jim Collins and Morten Hansen conducted research that examines what they termed "return on luck" - something every great company has benefitted from

"You must prepare intensively, commit all the resources you can, and be maniacal about execution when the good-luck moments arrive"

From HBR article by Morten T. Hansen (11/4/2011)

To paraphrase the concept, you can not predict when or what external forces will drive you forward but great companies benefit from luck through years of prior vision and execution - so they are poised to benefit when the luck arrives. The ZenGo team and BOV - and all investors - shared a common vision that crypto will become mainstream but none of us could honestly say when the "ah-ha" moment would happen.

We hope to look back and say it was right now - and if so, could also say ZenGo had great luck to have its main features ready at this moment. But as this case study aims to show — for the ZenGo team it was based not on luck but years of belief, hard work, making the right choices (e.g. MPC, focus on consumer, saying no to distractions) and tireless devotion to execution.

Finally, I hope that we will all look back at the introduction by Yaron Samid (a BOV venture partner) to Ouriel and me with the simple - "you guys have to meet" - as one of those lucky moments for all — providing the company a lead investor with more than just a common view of mass market crypto adoption but whose conviction model of investment will have contributed to the ZenGo journey from good to great!

Thanks so much for reading. If you liked this post, please click like and share with your friends! And if you use or consider use of crypto, download ZenGo!

Great read, great company & great product.