The Inevitability of Web3

Web3 is a Technical Enabler, rather than a magical Investment Category

At Benson Oak Ventures, we have been early believers in blockchain and always took a view beyond the speculative hype -- that its power resides in its utility as a global ledger of record that affirms ownership. The recent crash is useful in removing layers of hype and what is left standing manifests how far blockchain and crypto have actually come - an ecosystem of apps and services that is used by many as a digital representation of real-world goods (membership, rewards, ownership, earning, etc) and represents the Internet infrastructure of the future.

Let’s be clear: Web3 is not really an investment category. Just as nobody anymore claims to invest in the “Internet”. Web3 is an enabler for the next generation of platforms, services, and marketplaces.

We believe decentralized blockchains (aka “Web3”) represent the backbone for a secure, open-source, trusted Internet that will reduce friction to unleash a new age of commerce. In the decade(s) ahead, we will have the benefit of hindsight to say "it was inevitable" - just like we do now looking back on "The Internet" and digesting the dot-com crash as a hiccup. I have enough gray hair to recall it was not considered as such at the time — however those with belief, patience, and willingness to invest generated outsized returns.

Those returns emanated from “Internet-enabled” businesses, with their mass-market scale across the globe resulting from the ease of distribution and monetization for re-imagined access to goods and services. As we have written often, this has come with a price: the Internet is largely controlled by centralized actors who possess the gold pillars for customer acquisition: user data and distribution access.

Source: UserGuiding

The next generation of new businesses will thus be “Web3-enabled”, where the technological revolution of a public ledger affirming ownership acts as the great equalizer for access to, engagement with, and monetization of users.

There will be an immense impact on the types of businesses, their ownership, and their revenue models. However, it is still largely in its nascency. As a venture investor, this represents one of the most exciting times to invest in early-stage ventures - with patience and conviction as well as a caution to the hype. Lets dig into the question of Inevitability.

Web3 as an Inevitable Enabler of Growth

Source: Crypto.com - World Bank - Global Macro Investor

Our basic belief in Web3 infrastructure replicating the growth of Internet-enabled businesses is reflected in similar engines for removing friction points between creators and users. It is not about the "religion of decentralization" but -- as in the past -- is all about technical infrastructure building.

The power of blockchain is in creating new forms of communication and inter-operability between apps and services, removing friction points to enable distribution and empowering trust. The current version of the Internet is limited in all these areas by walled gardens. What elements it does possess are due only to centralized actors providing the middle-man function of trust, distribution, and inter-operability -- and charging enormous rent for the privilege. Hence the limitations. Remove these friction points and all sorts of digital commerce will be unleashed - both imagined and unimagined.

Scalability & Speed

In terms of scalability, bandwidth unlocks innovation. Today we take the ability to video stream anything and everything on demand in perfect quality as a birthright. For those that remember AOL and dial-up modems (yes that was before mobile phones), the 500X increase in bandwidth in the last 20 years has likely had the single biggest impact on the growth of digital communication and e-commerce.

Inter-Operability

Communication has reached unparalleled heights across the globe among people and between consumers and vendors. But inter-operability among services remains fragmented and covers a very limited portion of the Internet. While there has been a massive increase in operability through APIs, this is purely through self-interest and as each network controls its own user data, they decide unilaterally whether to allow anyone in. As Chris Dixon points out here,

"Larger web2 networks almost always decide not to interoperate, and because they fully control all the user data, this is easy for them to do. Play this logic out over many years and we end up with the internet we have today, where almost no applications/networks interoperate. This is a bad outcome for network participants: users have worse experiences and get locked-in to applications. Web3 creates new systems where the rules are enforced by code .. and the incentives of the network and the network participants are fully aligned."

In Web3, Blockchain provides cross-app communication by default, enabling cross-chain utility & seamless communication among digital assets regardless of network size & power. Inter-operability thus stems directly from the alignment of incentives of the networks and applications with those of its participants (users, developers, creators, etc). The result is the enablement of new apps and services combined with ability to scale - on their own.

Decentralized Protocols: The next App Platforms (but not Stores)

With bandwidth generating the technical ability to scale transactions and inter-operability allowing small players to punch above their weight, we need distribution to truly generate mass market usage. Here we have two major trends happening right before our eyes regarding digital assets: access and utility.

Blockchain Protocols will be the engine of growth for Web3 Apps and mass market adoption. Apps and games on mobile exploded because iPhone and Google Play enabled (add chart and number of apps).

Source: Statista

Protocols have matured on a technical scale (due to billions of dollars in investments), transaction trust, and security (more network validators). These protocols will become the basis for a new wave of apps, games, and services where developers and users benefit from direct accessibility to users, inherent inter-operability, and unlimited scale.

Here we apply a simple formula --

Protocols: Web3 Apps & Games:: iPhone & Android: Mobile Apps

Plus you can add an addendum to the formula from a dollar perspective by deploying “70% of” in front of the second element of the equation. However, protocol incentives are different as they are aligned with their developers around usage of their blockchain which instead reflects a non-zero sum game for splitting the pie.

Here come the Brands

Brands will bring the direct utility of digital assets across a spectrum of use cases:

Brands will use digital assets to reinvent their engagement & business models with end consumers, creating new communities and entire service categories. This is already happening with many announcements just in the last months. We are still in the initial period and expect major revolutions in how companies - especially in sports, media and entertainment - utilize digital assets, result in education and seamless education for users.

In our portfolio we are already seeing interest from leading brands in fashion, apparel, beverage and more to partner in bringing digital asset experiences to their users. Strong brands have the trust and mindshare among their users and their use of digital assets in every day experience will enhance utility and turbocharge growth.

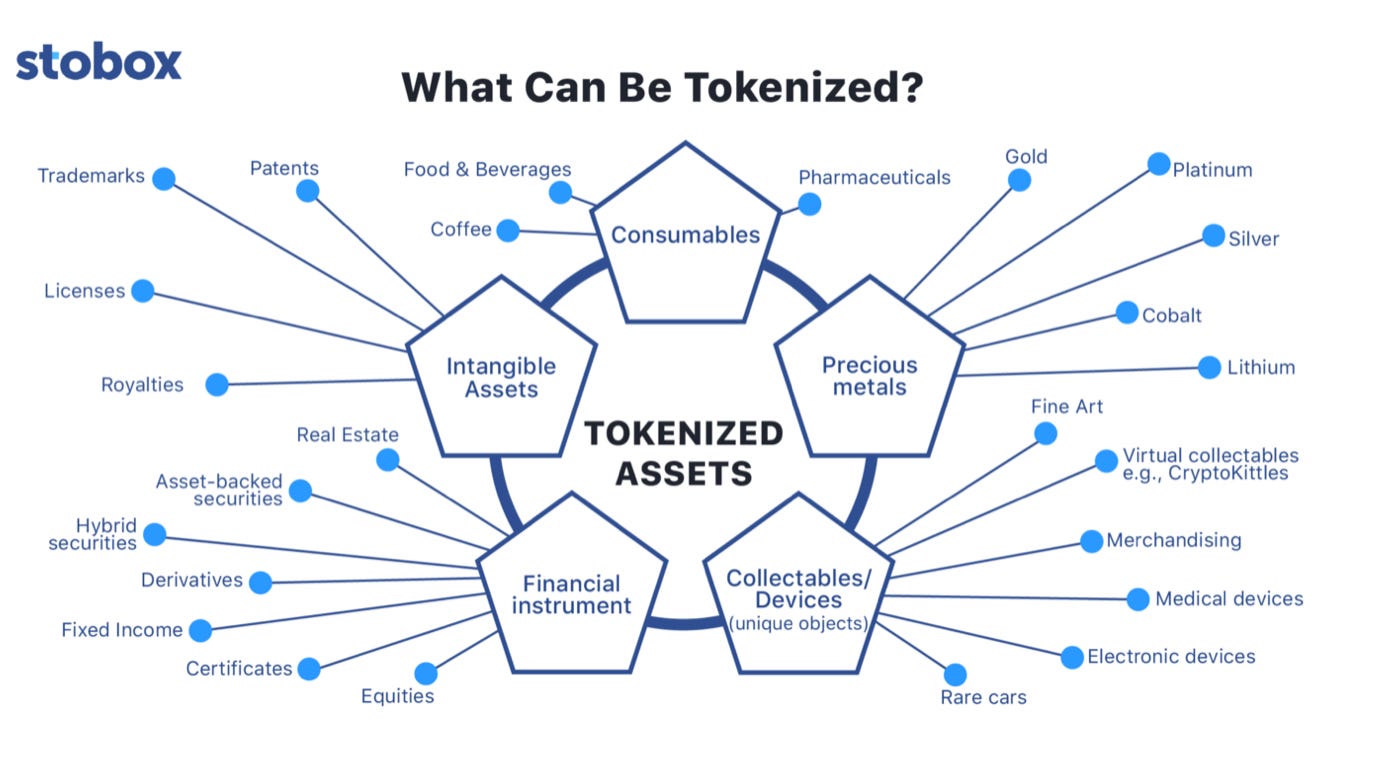

The Tokenization of Everything

This headline admittedly sounds grandiose. Tokenization is not a religion and it is not an end all-be all replacement for all forms of economies and markets. It’s just “good business”. Trust in tokenization will resemble a natural evolution dictated by market forces, stemming from the technical and market advancement outlined above. Think of it as another tool that all businesses and service providers (public and private) will have to provide for the betterment of the user experience and the customer-vendor relationship.

The use of digital assets will go from niche to requirement - just as websites, social media pages, and apps before. Events will provide tickets in physical and digital form, SaaS subscriptions will have both email sign-in and token-based confirmation, your driver's license will be laminated and/or held on a public ledger, equity securities will be held by brokers or in NFT form, collectibles will by physical and digital. It just so happens the digital forms will provide a better user experience for consumers, enhanced business models, and a far more harmonious relationship between vendor and user on multiple levels.

Source: Stobox

Conclusion: Get Ready for a New Wave of Start-Ups, enabled by Web3

We believe that history is repeating itself when it comes to a technological revolution enabling a new generation of consumer- and SMB-focused businesses. That revolution has been neatly summed as “Web3” encompassing the use of digital assets (a.k.a crypto, NFTs) running on decentralized public ledgers (a.k.a blockchains).

At Benson Oak Ventures, we have been investing in businesses catering to consumers and SMBs for 20 years and our focus is to invest in Founders obsessed by great product experience and all related KPIs — retention, engagement, brand, product-led growth, etc… .

From an investment point of view, we believe the "Inevitably of Web3" means using Web3 infrastructure, incentives and shared ownership models to enable these start-ups to build better products, grow faster, engage with customers better, and bootstrap longer thanks to lower cost of acquisition.

Some of these new investments will be dominated in traditional equity and some in tokens (eg protocols based on supply and demand of a common currency, or DAOs with distributed ownership). In the end, what matters is that great Founders will build new revenue-generating businesses, undeterred by market conditions and this thing called Web3 will enable them to scale to new heights with better products and business models. Exciting times are ahead - and lucrative ones for those with a long-term view to venture capital investing.