This is part one of a series on Benson Oak portfolio companies servicing the Passion Economy by providing key infrastructure to SMBs to enable them to build and scale their online businesses.

The first piece is on Promo.com, an investment from our previous fund and the largest Benson Oak Investment to date (hello, conviction model). The below is a foray into the history of the company including its previous interactions with VCs, as it gets ready to announce a recently closed funding round (stay tuned for that!). Congratulations to Tom More and the entire Promo team on the success and excited for this new phase!

Good gracious, it’s been almost five years since Promo.com launched as the first platform to empower SMBs to create video marketing tools - easily, affordably and quickly. Five years since VC investors reacted to our SMB-focused pitch with quizzical, confused faces like we were a novelty act in the circus. The Benson Oak investment thesis for Digital SMB has always revolved around the concept that SMBs would do anything a big business could - just a question of means and capability. They would do Super Bowl ads if they could!

Enter Promo. In 2015, Slidely existed as the predecessor to Promo, a B2C product from the creative genius of CEO Tom More (side note, creative genius is not a term I use lightly but I have had the pleasure of watching Tom at work and it 100% applies), enabling consumers to create slideshows, collage and other visual creations from their social photos instantly. As Slidely reached 60 million creations and over 100 million users from around the world, I helped the team do a deal with Getty Images to add professional photos to the site, and innocently requested access to their video API key, knowing the team was thinking about mobile - it was less than 100,000 videos at the time! Tom played with the videos over a weekend and his creativity birthed Promo as a completely new way to think about video creation for business.

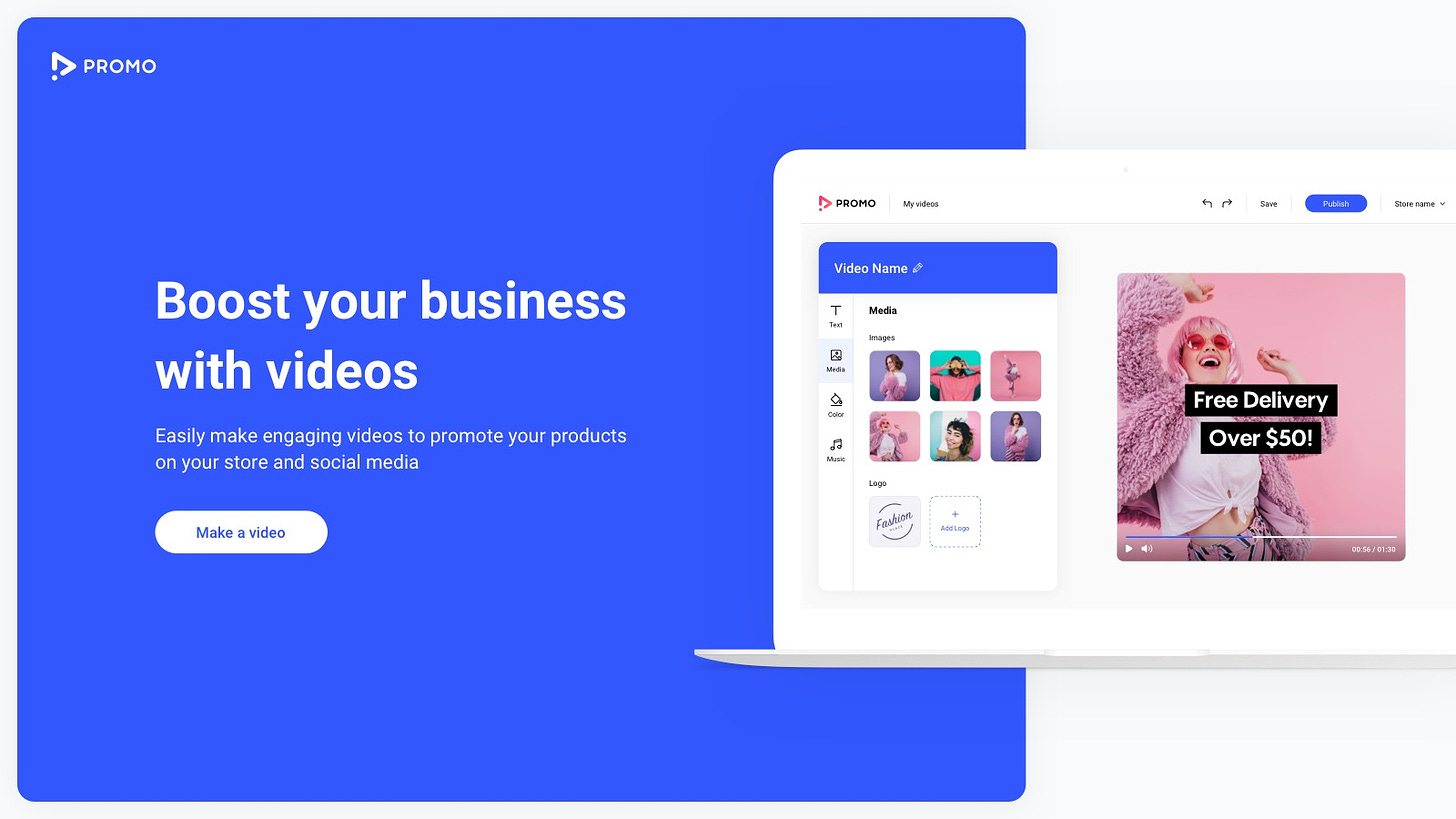

Tom’s insight was to turn creation on its head with the premise that SMBs do not have the budget for Adobe Pro, the time to follow 10 minute YouTube instruction booklets or shoot their own footage and certainly not the capabilities to figure out complicated drag and drop menus to produce a video they would be proud to call their own, not to mention coming up with unique copy every each time. The value proposition of Promo was simple - create it for them based on their type of business, and provide the video, the copy, the music, all wrapped in an easy and intuitive UI/UX so they can basically add their logo and they areג done.

Tom and the Promo team cooked up a demo of the product in record time and Tom and I flew to New York (yes, that’s how business was once done) and presented to Getty executives the product. We needed two essential things to turn this creative vision and slick product into a business - permission from Getty to use the content for this completely new purpose and, most of all, at a reasonable price. They loved the product but pointed out a flaw - “you dont have access to our videos”. Once we got over this technicality, the Getty team was prescient and saw the potential and the outlet for its content to an entire new user base and thus gave us a 3 month window to release and try the product. Yes that’s not a typo - 3 months! With that permission and lifeline, the team executed and set out to release Promo.

Yet there was another challenge - the company needed funding as our follow-on seed round was running down. So off we went with a track record of users, a deal with Getty and a great product - what every VC will want to back, right? Today everything is SMB this, SMB that, but in 2016, SMBs were not considered a growth area but more like a waste land of low paying, high churners. When Tom and I write the Promo book, we can fill a chapter of quotes from VC meetings but the most memorable was being asked the target ARPU, Tom said we are modeling $60. After the VC noted $60 a year wont bring much, Tom emphasized it’s monthly. Talk about a priceless reaction. Like a 13 year old telling his Dad he wants to make a million dollars by the time he is 16, we got nice pat on the butt and a zinger of which text can not adequately capture the condescension:

“If you get 50 SMBs to pay you $60 per month by this time next year, I will be impressed”.

I passionately believed otherwise and from my experience with AVG, I saw the power of SMB lifetime value and the similarity to acquiring SMB and B2C users. AVG is known as a consumer brand but a huge portion of revenue came from SMBs and they didn’t heavily churn as they long as they stayed in business and were satisfied. We needed Tom and team to focus on the product and early launch (see our post on Conviction Model) and transform their performance marketing skills to Promo, so we funded the round ourselves. Seeing the opportunity I also personally went all-in and went full-time within Promo, aiming to support Tom and the team in a myriad of ways including partnerships and business strategy. Within 2 weeks we had those 50 SMBs and by the first full year of launch, $7M in annual revenue. And our average ARPU from almost 5 years of cohorts - $59.

Maybe you are not surprised that VC did not fund Promo.com in 2016 - it was pre-launch, SMBs, etc. But when we went to market in 2017, that VC quote hadn’t aged well - we had 15,000 premium subs paying exactly $60 monthly ARPU for the product. Hockey stick growth, great customer acquisition metrics, huge market opportunity, we added Shutterstock content (the only platform with both), we even did an acqui-hire of a team in Poland… lets go raise a big round.

Ah, but there was one flaw in the story - churn. We were operating and presenting this as a SaaS business. Traditional corporate SaaS business have low churn and use net ratio and fun-filled buzzwords that have nothing to do with SMBs. The reality is we were in a very early phase of the market and this was an early “infrastructure” product in a nascent industry - Promo ads were focused on telling users why video works to convince them to try the product. It wasn’t must-have for many user nor necessarily to be used every day. So we were sort of jamming a subscription product when many users either wanted to try it first or just get a few videos ad-hoc. And this is fine because we were acquiring users at such a rapid pace and quickly finding who were the right customers (longer LTV) and who needed time to grow into full usage. And we were even cash flow positive (heavens, no!). We saw the pattern with VCs, so again Benson Oak funded and let the team execute - building its mobile products, a Shopify app, adding new content and other business partners and build for the future.

Great companies are not built overnight and history is littered with companies that could not get funded and became huge. I’m sorry VC community but we have missed a bunch and it often requires patient, crazy, visionary founders to show the light. An excerpt from Tobias Lutke, CEO of Shopify, on Reid Hoffman’s fantastic Masters of Scale podcast (“Be a Platform”) exemplifies this especially when it comes to SMBs —

when I was meeting with venture capitalists, they always wanted me to answer how big the TAM was. ...Which I always got terribly confused, because this is retail, you realize retail is basically everything…. And so it's like, this is so unbelievably big. I don't know why I have to make the case for that. But then I would get back that they estimated that – this is again, middle of last decade – that there's only about 40,000 online stores online. And even if I could get 50 percent of those, that would just be not that compelling of a venture capital investment….. And to which I always try to say, well, you realize why there's only 40,000 stores? Because no one has ever built software for the new businesses. …..that is why it didn't look big. So it's a completely chicken-and-egg problem that I was trying to tell them that I want to solve. Now, just on Shopify, we have a million merchants on the platform. Every 50 seconds a new business has their first sale on Shopify alone, right? And it's not that we have all of the market. So it just was so obviously important, obviously big, and there was obvious reasons why this wasn't growing, because it was so hard, and only the Venn diagram intersection of people with an interest in retail and computer programming abilities could actually be new entrants into the space.

Every company is now in the video content game and its table stakes for SMBs and who playing in the passion economy. Tom’s key insights five years ago was to (a) see the trend of video coming and (b) know that SMBs needed a “push product” not a pull. SMBs have a business to run and just want to promote themselves. Promo makes it easy for them to product beautiful videos at scale, with access to 100M videos and photos as well as your own content. But Promo doesn’t intend to compete as a video editor - as video content is just the base for SMBs, what they really need are marketing results to really scale. This is the next phase for Promo and the bag of tricks Tom and team have up their sleeve - and now an extra injection of funds (in addition to the consistent monthly subscription revenue) to execute on the plans.

Soon, Promo.com will announce the details of the new funding round and we are super excited about the choice of investor and the prospects for the future. With the injection of new capital and strategic expertise, the company can now further execute on its plans and leverage its assets including:

Promo brand as the #1 video creation platform for SMBs

Unparalleled content access photos from Getty and iStock, with unlimited footage available for premium customers

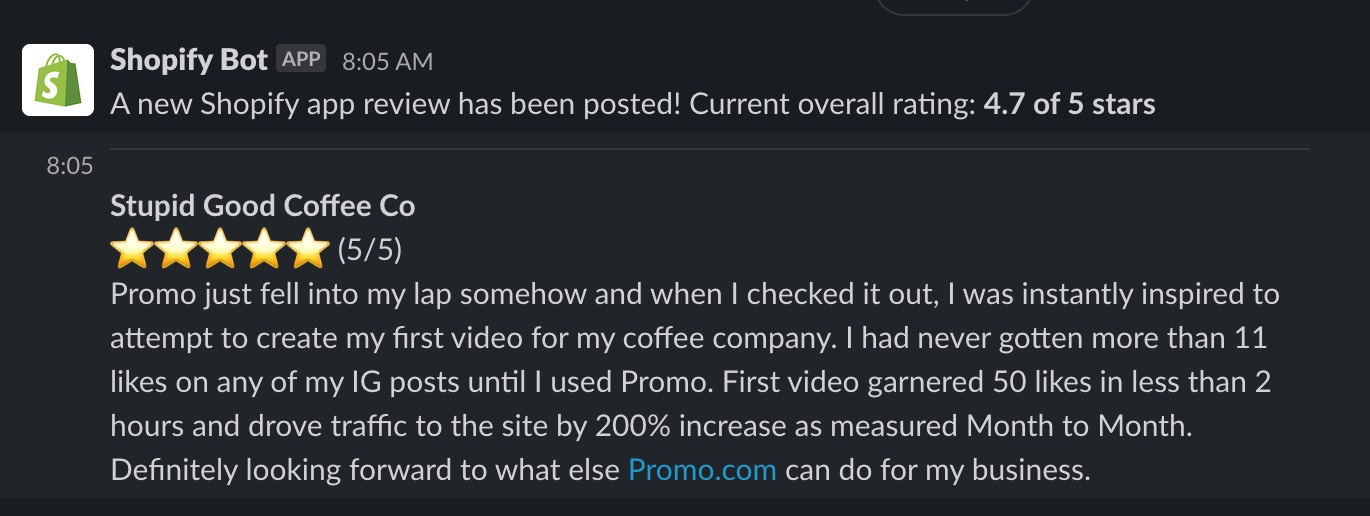

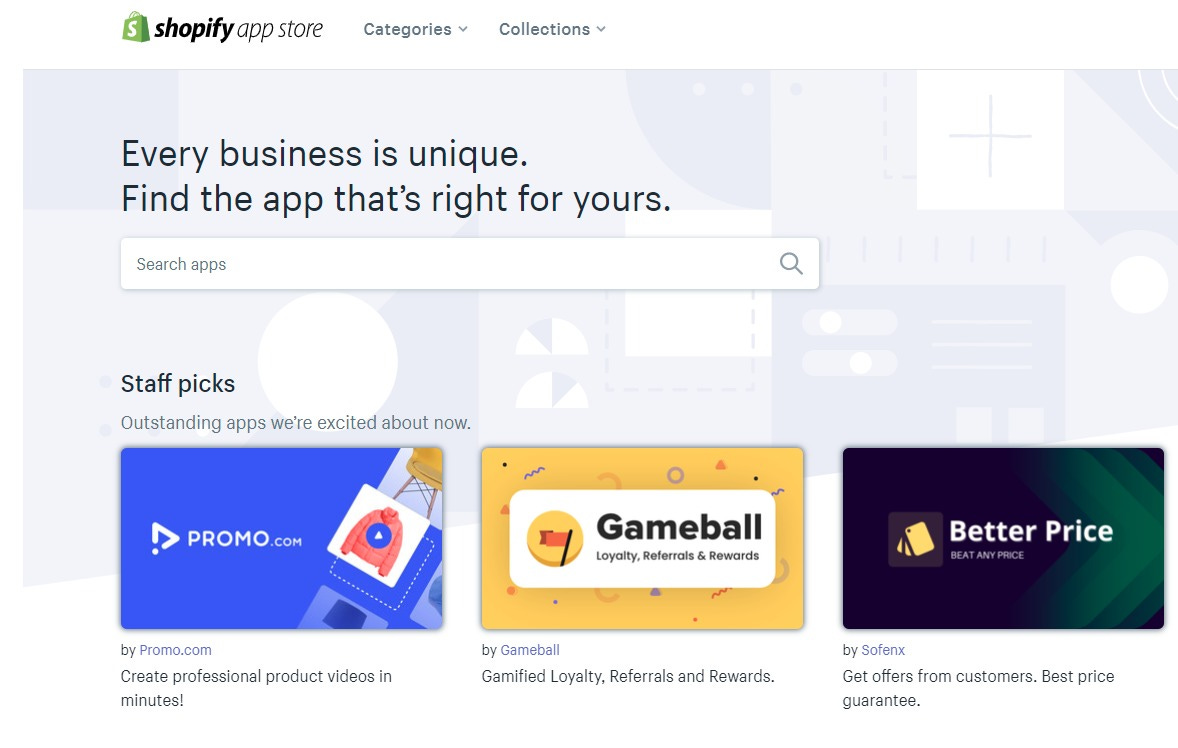

Shopify app that is the number #1 video app in that marketplace, and among the leaders in the App Store - and again now a top pick by Shopify

And leverage Tom’s creative genius that is already kicking up new ideas that again will leave the competition trying to catch up

Promo.com has been close to cash flow positive since our last investment in 2018, so the new funding injection is mainly targeting growing the team and hires for all key positions including revenue and marketing (CRO, VP of Marketing, Head of Content), a host of developer and product positions, including R&D Group Manager, Product Management, Head of Analytics). The CRO job in particular really is an amazing opportunity — if I didn’t have a day job, I would consider applying to go back in!

For more info, go to https://promo.com/careers

If you know anyone who wants to be part of Promo’s next phase and help make that Israeli success story a reality, while servicing SMBs and the passion economy in a huge market space with a visionary leader, please reach out to me or t@promo.com.

Stay tuned for more news from Promo. If you like this article, please share — especially with potential hires for Promo.com!