The central event of the 20th century is the overthrow of matter. In technology, economics and the politics of nations, wealth in the form of physical resources is steadily declining in value and significance. The powers of mind are everywhere ascendant over the brute force of things”.

- George Gilder, Microcosm, written in 1990

Reid Hoffman quotes this futurist verse in his book Blitzscaling in his discussion of "Software Eating the World" where online channels drive businesses (old and new) and create new markets, ease efficiencies for consumers and businesses alike and increase opportunities for both entrepreneurs and new breed of gig workers to earn a living and accumulate wealth. Over the last 30 years, the Internet has indeed eaten the physical world but it has largely followed the macro-trends of the "old economy" in enabling new, centralized players to control the pipes, payments, access, and match-making (they resemble Gilder’s "brute force of things" still).

We are now on the cusp of a whole new era of commercial transformation that will "eat the old". NFTs and digital native solutions are the next iteration of the ascendancy of “power of mind” and will undergird this new world, with blockchain and its revolutionary way to disseminate decentralized trust among commercial actors acting as the operating system. NFTs are the currency of this new world not just as medium of exchange but as we wrote in our May 2021 blog, they are much more, serving as operational business infrastructure, engagement with fans & users (community-building as form of sales promotion and even investment) and business model flexibility and scale.

NFTs enable the creation of new economies which with growth and scale, will embody all the components of physical economies - production, market-making, development and even investing and trade between them. It is this combination of digitally native micro-economies and global communities based on NFTs & blockchain that underpin the investment framework for what we call the Digiverse.

Source: ThinkStock

This is Part 1 of a multi-part series on the Digiverse and Passionware 2.0. Please subscribe to get the next one automatically to your inbox!

Lets get some definitions out of the way -- a few are natively branded!

NFTs:

Datafile stored on a digital ledger, called blockchain, that certifies a digital asset to be unique and therefore not interchangeable. While copies of these digital items are available for anyone to obtain, NFTs are tracked on blockchains to provide the owner with a proof of ownership that is separate from copyright.

Passionware:

Tools enabling the creation of products and services stemming from people’s own creativity - enabling anyone to be an entrepreneur, run a business to earn a living and, at the same time, fulfill one’s passions.

Ownership Legos:

NFT-based building blocks which a creator can use to produce any type of ownership asset that can be packaged, disseminated and traded directly by the creator and their community using only NFTs.

Metaverse:

often used for our definition of Digiverse but we will use its literal definition coined by Neal Stepheson in 1993: "a collective virtual shared space, created by the convergence of virtually enhanced physical reality and physically persistent virtual space, including the sum of all virtual worlds, augmented reality, and the Internet"

Digiverse:

group of inter-connected decentralized ecosystems built on technology protocols in which NFTs enable the creation and expansion of economies formed by communities and entrepreneurs seamlessly working together on a global scale.

The Digiverse Revolution: NFTs as Building Blocks

While the Internet was transformational in nature, it really is an evolutionary step of taking old economy artifacts and putting them online, engendering scale and increase efficiencies. Moreover, the Internet does not provide equal access - regulatory and corporate permissions are still needed to access most content and services of the Internet, especially for those without access to banking or good financial systems.

The Digiverse represents a revolution. It may sound like hyperbole, but we believe it is hard to overestimate the ripple effects of the digitalization of everything and how it will impact every aspect of the economy far greater than that of the Internet on the "old economy".

The collective creative mind of humanity (powered by Moore's law of computing power) is rapidly creating pure digital native platforms (a.k.a decentralized economies) to engender direct relationships between creators and fans, including access to developers, investors, suppliers and basically all elements of "old world" economies. With digitalization comes removal of barriers, whether based on geographies, access to capital, portability, permissions granted only by middle-men. For consumers, the array of services available is global in nature and permissionless; for entrepreneurs, consumers are reachable across the globe, and both human capital (developers) and financial capital (debt and equity) are readily available from myriad of sources (including consumers themselves). Finally, for larger brands, there will be immense opportunities to find new markets as consumer behaviors inexorably are intertwined with these new communities especially in the Metaverse.

NFTs 1.0: Proof of Ownership Utility

Fungible tokens include Bitcoin, Ethereum and the host of coins that can be used as currency just like fiat, i.e. interchangable as means of commerce. Those coins have different use cases but in the end one “XYZ-coin” can be used like every other “XYZ-coin.” These currencies have become volatile because their supply is fixed and demand drives price up (and vice versa).

NFTs are non-fungible meaning they are unique and cannot be replaced with something else. NFTs are the building block enablers of the Digiverse by acting as digital proof of ownership. The token represents an asset, defined by a smart contract and permanently written to the blockchain. They can be bought and sold but no matter what, ownership and provenance are always immutably tracked by the blockchain.

"Money is "purely mental revolution.. it exists solely in people's shared imagination

- Yoav Hariri in Sapiens

Governments are not really needed for trust of currency but for minting it; now technology code and smart protocols do the minting and the community brings the trust.

Digital proof of ownership changes everything, making possible decentralized economies that do not require a middle-man to decide whether you have ownership, permission or provenance. With relative ease made possible by this trustful imagination, this replicates the way traditional workings of old and new economies. Things like memberships, digital subscriptions, events are manifested by ownership credentials or a ticket, registries and contract interpretations determine ownership, payments require processing from one account to another, investing entails shares or debt registries, etc. In the Digiverse, NFTs are the smart arbiters of ownership in and access to the "club", and not a bouncer, lawyer, bank or administrator who has to say "he or she is ok".

NFTs are therefore about utility - the underlying asset represented by the token will have value based on supply and demand, not the NFT itself. Yes NFTs now seem like a bubble as Bored Apes and Pudgy Penguins sell for millions but as with many hype cycles, speculative value often gives way to functional value. As Jesse Walden of A16Z writes in this great primer.

"NFTs are user-portable, programmable assets that can take on new utility across the totality of our digital world". NFTs are "media legos" for developers and creators to permissionlessly remix and build new experiences around. As a result, users can look forward to richer experiences, and compounding utility around the items they own".

NFTs 2.0: "Ownership legos" that Spawn the Digiverse

With NFTs a utility, all content (which can now be much more broadly defined) can be packaged into smart contract and developers, creators and fans (and reminder these buckets overlap) can build new experiences around them. The result is a true ownership economy for benefit of both micro-sellers (SMBs) and buyers (B2C) and everything in between, as ownership takes on whole new meaning and NFTs really become "ownership legos".

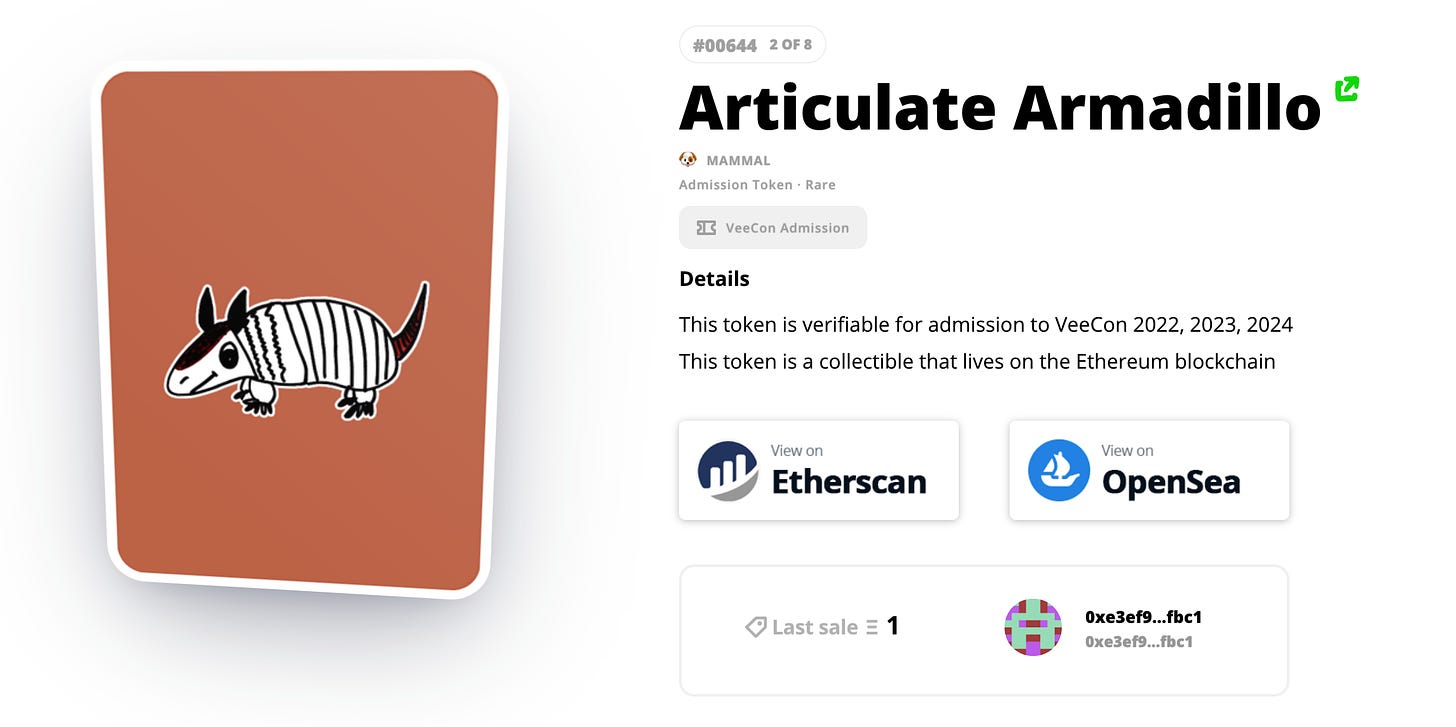

New digital assets enabled by NFT ownership legos include the following buckets and we are going to use Gary Vaynerchuk’s VeeFriends project as an example for each. These are NFT-based assets, which as we note in our NFT blog "grants you access to an event (VeeCon), access to Gary himself, plus ownership rights to the artworks which Gary intends to brand the BEEP of". Three overall products in one, and they can be traded on secondary markets. This GaryV economy is wholly made possible by NFTs.

Effectively, NFTs fulfill three vital components of the Digiverse:

(i) Creation of new assets - lifting all limits on what can offered to users as a "digital good"

(ii) Seamless Access - administers access and port of entry for owners of those digital goods

(iii) Dispersed Ownership - the community can benefit from the asset (and hence economy) through ownership, encouraging promotion, investing, distribution and even further development.

Creation of New Assets:

Analogue Assets Go Digital. All analogue assets can be replicated in the digital world. It is not an accident that NFT exploded with assets that "skipped the Internet world" but now can easily move to the Digiverse:

Examples: physical collectibles like art, sport cards, and the like.

The Future: by providing an outlet of ownership, the Digiverse has already created a booming market around "digital art" creating new artists, new buyers and an entire ecosystem.

VeeFriends Analogy: GaryV created artwork and is selling them as "JPEGs on the Internet" ("only more").

Internet Assets go to the Digiverse. Trillions of creative works are on the Internet and are difficult to monetize, except through licensing models and ad-based businesses.

Examples: Media, Music, Content.

The Future: By digitiziting and creating assets from digital property and intellectual property, NFTs place these assets in an "ownership bucket" that can be priced, sold and traded.

VeeFriends: In the past Gary V could do licensing deals with his newfound artwork and share the revenue with printers, distributors and the like; now they are in NFTs and shared with his community of fans who are promoters, investors and the like.

Define and Package Content. Anything can be a service as long as can program it into NFT. All forms of content, products and services can further be combined into one offer, with only limits the imagination of the producer (and the value perceived by a consumers).

Examples: Private Clubs, Service Providers, SAAS subscriptions, etc.

The Future: With NFT, anyone create a club and charge for entry and/or membership to participate.

VeeFriends: GaryV basically made himself the content and then packaged access to his art work, to himself and to his event in a "token", creating a new ownership asset around Vee Friends

Access

Proof of Ownership. Most real-world assets are in the form of registries even if they are expressed online - often difficult to adjudicate without lawyers and prone to fraud.

Examples: Contracts and provenance

The Future: Fraud is "blockchained" out of existence and experts are not needed to prove a piece is real; physical and digital items now can exist with on chain proof of ownership. Aside from digital art, we see the the interest of LVMH, Bulgari and others to create scarce digital representations of their real world objects and products

VeeFriends: Here is piece of artwork, I purchased for 1 ETH back in May. My NFT token held in digital wallet is my proof of ownership.

Proof of Access. In the non-digital world, you need to "put your name on the list" or get a physical ticket to an event; the Internet enabled an email and a password (SAAS is a form of club) or Facebook to verify identity of membership and mobile phone promulgated QR codes. All are unwieldy to distribute and store, and none are easily transferable.

Examples: Events, Subscription, Membership

The Future: NFT in your digital wallet provides entry

VeeFriends: the token shown above is my entry to the VeeCon event

Pricing Tiers: NFTs are non-fungible but the owner can make multiples of the same NFT, each of which are non-fungible and price accordingly.

Examples: Freemium, Premium Subscriptions

The Future: more flexibility in the quality and quantity of tiers combining all of the various creation aspects. Scarce NFTs with more "stuff" programmed into the package are more expensive than abundant ones doing just one thing. By mixing and matching, the businesses of the new world can experiment and iterate faster and segment their users in much more targeted ways than "traditional" online businesses.

VeeFriends: GaryVee created 10,255 tokens, all of which include artwork and grant access to his event ("ticket") but only 108 grant one-on-one access to GaryVee. All in all, there are 10 types of tokens, all with different forms of content defined, packaged, quantities, and therefore prices. My Armadillo is an admission token only but also is a rare (1 of 8 such Armadillos were made).

Proof of Payment:

Examples: Credit Cards, Payment Processors, Stripe & Square

Future: Payments from your digital wallet in crypto and fiat. Eg ZenGo will serve this function. This future needs time to solve the UI and also cross-chain issues (more on that later) but its inevitability is the reason the banks have the most blockchain patents and Visa is partnering with multiple wallets (including ZenGo) as well as expending $150,000 on a CryptoPunk to show they are "new school"

VeeFriends: I paid in ETH connected to a Metamask digital wallet and automatically received my Armadillo NFT. No person was involved (and no, I dont want to explain to my 30 year old self what that sentence means).

Loyalty Points:

Examples: Airlines, Restaurants and Hotels

The Future: NFT's enable any entity or person to have loyalty points that come coded with special access to online and offline events with broad range of benefits and portability rather than siloed and restricted

VeeFriends: Benefits are embedded in the Pricing tiers

Dispersed Ownership

Royalties. Royalties are payments that buy the right to use someone else's property and in the old work require contracts, lawyers, enforcement and often lawsuits.

Examples: Today this is contractual, hard to keep track and requires middle men to get deals. Since all that is complicated, most media is just handed to a social network for free and they throw an ad model around it in return for likes and status.

The Future: NFT's embed the royalty payments in code - meaning as an NFT item gets sold, and then resold, the owner will automatically get the percentage written in the smart contract as the allocates payments.

VeeFriends: He takes 10% of any secondary sales. My Aramdillo (1 of 8) is now going for 11 ETH on Open Sea ($44K) and if I sell it, GaryV gets 10% of the total (which is fine when Im making 15x in 4 months).

Affiliate Models:

Examples: Affiliates are employed to push sales and take a cut of the revenue, a model that is plagued by fraud, tracking challenges, payment issues, and basically impossible for small companies and solo entrepreneurs.

The Future: NFT's embed the affiliate payments in code just like royalties and fans become incentivized affiliates via their token ownership

VeeFriends: All VeeFriends can be sold on marketplaces like OpenSea, and payments (including his royalties on secondary sales) are programmed

Community Ownership

Example: Community today is a dialogue through communication channels, one time and subscription payments. The community are really users whose main purpose is to be acquired, retained with superior LTV-CAC metrics

Future: Communities will have ownership in the content, decision making and will be part of promotion, marketing, business development and other activities to promote and push forwards their particular mission.

VeeFriends: The community drives dialogue and awareness, they will wear his Armadillo likeness Tee-Shirts and they fund VeeFriends by buying the work and will benefit as the value of IP increases for licensing deals he cut (yes, in the physical world!)

Developers

Examples: Businesses must find, hire and manage developers and adjust according to the rules of large platforms

Future: Developers can flock to an ecosystem and take programmable assets and remix them. The creator retains ownership of their work and has effectively "hired" multiple developers to extend it in new ways that are a function of the respective developers' own creativity, with clear rules that can never be changed, including all technical and financial parameters.

VeeFriends: Developers can build on top of VeeFriend and decide to start a membership club that require a VeeToken for entry. Ok we are getting a little cult-like but the point is this be done without permission as long as there is demand; NFTs provide the supply.

Voting and Governance

Examples: Participation today happens indirectly and without real enforcement as part of a product experience. User can participate by sending feedback, up/down votes, feature suggestions, or comments to communicate, influence and "Vote".

Future: DAO's as well as creators launching NFT's and giving voting rights to their fans. Fan$quad is building a crowdfunding platform where content creators sell NFTs to their fans and provide - amongst many other options - an ability for fans to be part of governance decisions for content creation and curation.

VeeFriends: He gets inspiration for content from his Fans on the Discord channel (1000s of messages a day) and at some point could surely provide voting right to token holders for decisions on future events, content and licensing deals.

All of the building blocks described above are effectively separate components for a digital business. The magic is in their evolutionary combination, as goods and services can be created from an idea and by anyone, easily accessed by fans who want to be part of it in some form and who spread the word on their own, enabling a market-network to take form through dispersed ownership of those owning a piece of the new economy via a token.

Put in blunt terms even (especially!) the Pilgrims would understand:

Some one plants a flag of their named community in a new world

Incentivizes more people to plant flags and seed and bootstrap the community

People that are seeding it are incentivized to make noise and bring others on board

There's now a club that people want to be a part of

People are invited to own part of the club: buying tokens, building things, staking, promoting, writing content, etc

Everyone wants to grow the club (and show off their new status!)

Conclusion

The powers of mind underlying Passionware economies are in the ascendant. The Digiverse inverts the ownership model and gives the power back to creator. NFTs as ownership 'Lego' bricks offer creators (and their fans) and developers a viable alternative to platform-driven monetization.

Using the lens of 'Passionware', consumers and small entrepreneurs (SMBs, solo) both benefit from scale afforded by digitalization. As the need for middle-man dissipates, lines will start blurring. Consumerism blends in with entrepreneurism, punctuated by mass market access and capabilities. All users act not just as consumers of their favorite products and brands but also contributors, promoters and investors.

There will a whole new category of "Me-commerce", as individuals or clubs earn directly from their contributions to a decentralized network. This will be a true democracy that works regardless of age, financial status, education or location. These new “entrepreneurs as contributor” are paid to follow their passions: they can play and crush in a game, choose topics for their favorite podcaster, curate art, make cool videos, and so on.

Benson Oak looks at the Digiverse not as crypto or NFT hype but from the prism of Passionware 2.0 where no one needs to know or care that blockchain is the technology that undergirds the ecosystem —

Digital-only platforms enabling the convergence of B2C & BSMB into new $100B+ economies, driven by millions of new “me-commerce” entrepreneurs.

The next parts - coming soon - will cover the Venture Capital opportunity in Passionware - how we see the size and development of this new market and where we intend to navigate the playing field as our investment framework.

Preview - huge market with mega-potential returns but VC strategies will have to adapt!