Digital Oak - All About DAOs

The new wave of shared ownership platforms presents enormous investment opportunity

Summary

There is a $60 trillion market opportunity across an entirely new playing field called Web3 where ownership is shared among its participants.

Benson Oak Ventures is investing in Web3 start-ups based on a core thesis around Passionware. We invest early — backing strong, passionate Founding teams who have strong product capabilities and skills to scale a community from early adopters to mass market usage. They are creating economies that unlock new forms of activity with multiple incentives for participation and contribution, powered by network effects, all orchestrated by a common token.

Web3 expands the market size of its targeted economy by removing middle-men and making everyone an owner, promoter, contributor. Aside from governance rights, the tokens provide accrual value to their holders through both direct ownership and price appreciation based on demand in direct correlation to the total size and activity of the economy.

DAOs are the Web3 organizing entities - how a Web3 start-up can organize labor, hire developers, raise capital, build a brand, acquire users and generate economic activity and revenue.

Tokens are Web3 equity - the currency of this opportunity and the basis for early-stage VC investments in Web3.

This post outlines our thoughts on DAOs and why investing in early stage token deals has the potential for outsized returns, due to their disruptive nature in changing the future of how organizations are structured. Benson Oak Ventures is at the start of a journey with DAOs. While it is still very early and there is plenty more to learn, the innovation we are seeing from Founders is incredibly inspiring.

In terms of investment returns, using a token as the investment vehicle provides:

Dividend Yields. Access to cash flow from holding the token, benefiting from a claim on limited transaction fees plus financial rewards from staking, financing and other forms of contribution

Value Appreciation. Enormous upside from trading the token, driven by demand among users for a fixed supply of tokens. There is enormous scope for upside when value is correlated directly with the potential volume of an economy.

Liquidity. Ability to trade the token in liquid markets, with less limitations inherent in start-up equity and reliance on one-off exits

DAO Phases. At macro level, there are two phases for DAOs. The goal is to reach the user phase with widespread adoption and usage among a community, powered by network effects. This drives demand-driven value appreciation of digital token. The first phase consists of creation, early adoption and investment.

By its nature, this first phase is more speculative, with higher risk and volatility. Most projects are now in this phase and there will continue to be ups and down - and many failed projects — until DAOs reach maturity with widespread adoption. This is the phase we are now in, providing opportunity based on long-term view and patience. We believe it wil happen fast — as we witnessed in just the last 6 months with NFTs.

DAO Structures - In Brief

A token is the stakeholder instrument for a DAO - shares with multiple purposes. Like shares, tokens provide ownership - in the form of both financials right to cash flows and voting governance. Unlike shares, tokens serve additional purposes: utility in which many participants can earn money from the system through a myriad of contributions that promote, enhance and grow the economy.

Decentralized Autonomous Organizations (DAOs) align their participants around common ownership - not for utopian reasons but as a potentially better organizational method for rapid growth and value enhancement in a nascent economy.

DAOs can be created for various purposes. As a venture investor, we focus on Product DAOs - building protocols or product-driven economies similar to a traditional start-up.

For both companies and DAOs, there is a founding team that kick-starts a project. The best Founders have a burning desire to solve a problem and the ability to execute through experience, skills, and network (i.e. founder/market fit) - this is no different in Web3.

It is also crucial to note the decentralized part comes later - at the beginning of a DAO, there is a Founding team that drives product decisions for the two essential tasks of all start-ups: find product/market fit and grow the initial community of users. The how is what deviates from the traditional start-up form.

Companies build entities that are dependent on labor exclusively tied to them, financed through multiple financing rounds, with organization divisions having specific goals all tied to the ones set by the management and the board as the authority.

DAOs are building long-term economies. Instead of a top-down corporate structure, DAOs distribute ownership to a range of different stakeholders as technology and smart systems provide incentives for contribution.

The result is a network.

Corporate vs DAO

A breakdown of typical Start-up Components

Ownership and Management

Companies concentrate ownership among founders and investors and use Boards to manage them and make key shareholder decisions on their behalf.

DAOs distribute ownership (via a Foundation instead of a Company) to a variety of stakeholders in an ecosystem, including contributors, users, strategic partners, vendors, and so forth.

Scaling Labor Force

Corporate structures were basically created as a way to scale and organize talent. That labor is compensated mostly via wages and second via start-ups options.

DAOs incentivize labor through shared ownership as the incentive structure to contribute. Developers and other contributors (promoters, curators, etc) are paid by contribution (via the token) as well as by fiat - to build apps for goods and services.

Financing

Companies sell shares for financing - an inflationary system that by its nature engenders dilution for early shareholders.

DAOs distribute tokens for a much wider range - early financing and incentivizing the community. Token supply is fixed or deflationary so no dilution on a FDB.

Marketing

Start-ups often use the proceeds from share sales for customer acquisition, usually handing it over to Facebook and Google to build a user base.

DAO count on the community for active participation, granting bounties, grants, and other incentive. Everyone is an owner and by consequence a marketer - with additional incentives for this purpose.

Revenue

Centralized services charge fees to access - think of a marketplace where the service takes a “vig” for providing the access to customers.

DAOs charge enough to cover costs and pass the value to the community - in absolute contrast to the take-rate economies.

Liquidity

Less than 1% of start-ups go public and those on average take 6 years. Until then, there is usually no liquidity and often investors are required to invest more to keep their percentage. For upside cases, you still get diluted and own 80% of your original stake - hoping to make it up on exit volume.

DAO tokens are meant to be public within 12-18 months, providing liquidity for early backers. And on a fully diluted basis over time, investors own the same percentage they originally bought until they sell. Plus they can buy more over time in freely traded market and/or earn from using the platform.

Shares vs Tokens as Accrual Value

In typical start-ups driven by equity, the company seeks to maximize its own revenue and profit (at the expense of partners and customers) and sell its equity in one package to buyers on the basis of its future cash flows.

In DAOs, the community collectively seeks to maximize the size of the economy and thus appreciate the value of the token as the network and ecosystem grow.

The Network of a DAO Drives Value of its Token

Web3 economies provide an open place for commerce - underpinned by shared ownership, all orchestrated by a common token.

Consumers derive benefit from the goods and services offered and the value accrues to the owner-creator not middle-men. There is no centralized take-rate charging “rent” for access, distribution, or services.

By accruing all value to the owners, and sharing that value with promoters, curators, financiers, and contributors, the focus is not on maximizing rents but on economic activity and shared value.

The resulting network effects changes everything. With no “tax”, true value is paid by the consumer and earned by the provider and the economy grows - as a function of monetary value and more players entering the ecosystem no longer intimidated by high rents and taxes. Stakeholder value across the community accrues through sharing the benefits of the token.

Value Accrual of Digital Assets: Two Forms

Yield-based Cash Flow. A DAO can decide to provide token holders pro-rata share of the money collected by the Foundation as well as yields and transaction fees. This value is like traditional finance — and can be calculated as the net present value (NPV) of annual value flows to token holders.

💰 For yield-generating tokens, more activity means more cash and revenue to the token holder - which can be allocated to token holder wallets automatically by smart contract when the community votes for it, as opposed to centralized entities that hoard cash rather than distribute to its shareholders.

Value Appreciation. The value of the token is directly correlated with the demand for the goods, services and apps offered in the economy. The value of the token increase with the popularity of the economy and the user's demand to access tokens for use in transactions and other forms such as staking and rewards. Token supply is usually fixed and parceled out over time to key stakeholders and contributors as rewards and token economics govern the supply issues.

⚖️ Behaving like commodities in traditional finance, tokens can be valued according to formula (MV = PQ), where monetary level (M) multiplied by velocity (V) equals price multiplied by quantity (PQ). Effective utility mechanisms are those that lower token velocity (V) or increase the utility of the protocol service (PQ) or ideally both simultaneously. The key is to design and implement mechanisms that increase the fundamental value of the token while reducing the token velocity. This can be achieved via mechanisms such as staking mechanism (reducing supply in circulation) and burning mechanisms (reducing the total supply).

Source: Outlier Ventures

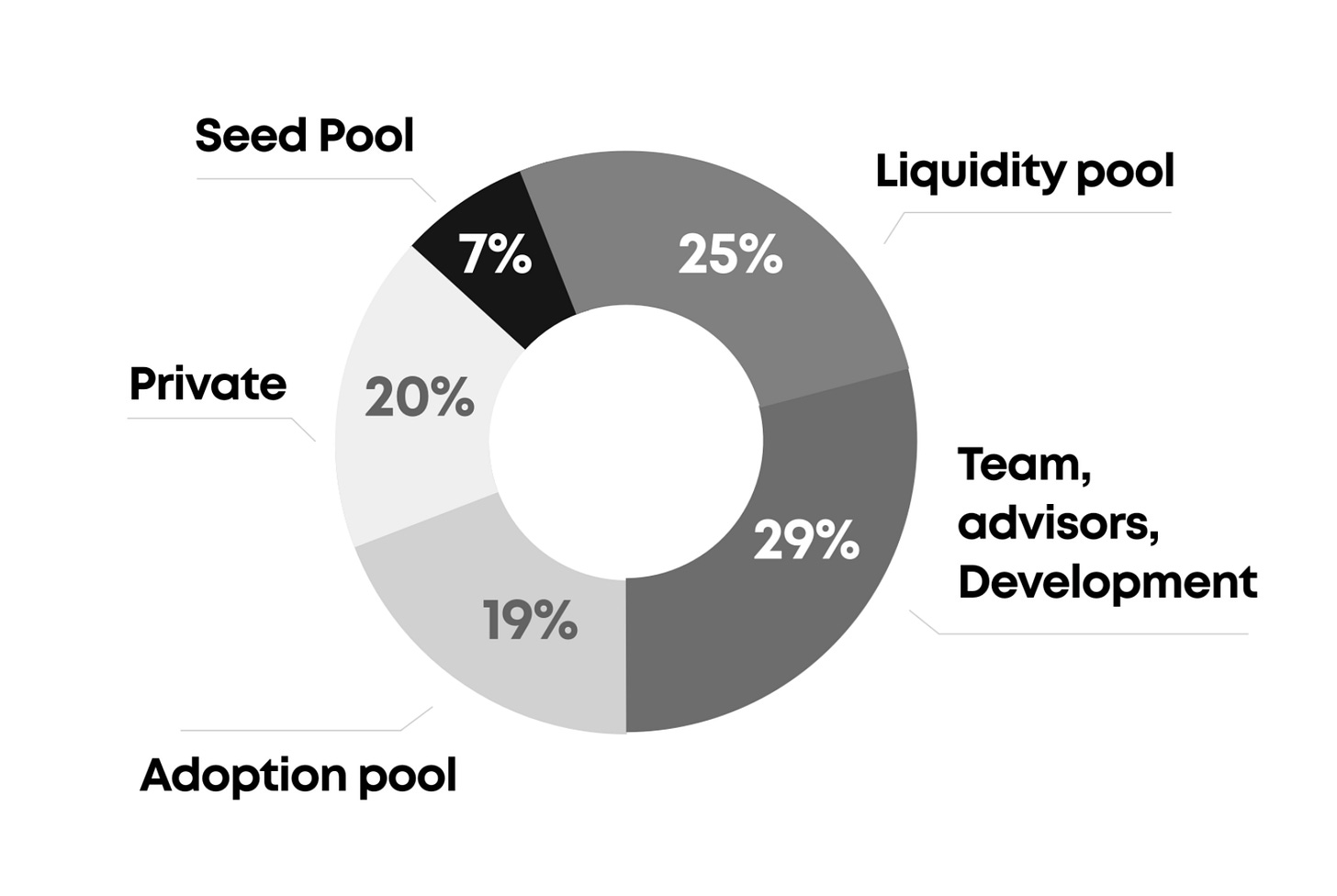

Equity is the currency of a start-up and serves as a single purpose, divided almost completely between investors and founders/employees. As the currency of DAOs, tokens provide multiple use cases and a shared pie among all its stakeholders. Here is an example of how tokens can be allocated. A fixed number of tokens, split along investors, user & early adopters and team, advisors and participating developers.

In start-ups, those few that succeed are usually highly dependent on very strong Founders who shepherd the company from start-up to exit or going public. Bottom-up organizations are not dependent on the original Founders. Once the economy is built, populated by users, developers, and working infrastructure, the Founders become one of many contributors and may not even be needed.

The value of equity is static, usually manifested once - at the end in an “exit”. The value of a token is dynamically driven by demand for a fixed supply of tokens. The community builds and sustains the platform and gets to vote on how the token works - hence determining its accrual value with complete alignment of interest.

Investment Decision-Making: 4 Question Approach

We look at potential investments in nascent Web3 economies through the prism of overarching 4 questions. All questions come back to the basics of how big is the Economy and how much activity will there be, therefore driving upward pressure on the token once it is in use.

How big is the market potential? This is a function of the current market size and the new market opportunities being created as more players enter the space -- whether due to existence of an entirely new offering oer because no longer intimidated by high take rates. Many familiar markets will simply be transformed to the new world, greatly expanding their output and efficiencies and enabling a long tail of viable businesses -- running the gamut from content to fashion to services to gaming to real assets such as homes, cars, and land.

What take-rates are being removed? The speed by which a new economy will attract early adopters and then scale is directly related to the take-rate of centralized equivalents. In content verticals such as art and music, gaming, social media (and much more), the creators will flock to platforms where they can derive the value directly, thereby increasing the TAM and speed of adoption

How will you scale the community? And do it better and faster than others? The winning Web3 businesses will have similar characteristics as Web2: strong brand and great UI / UX, with the addition of incentives for multi-layered participation to produce network effects and growth. Many will start with traditional marketing and old-fashioned business development - but then key signposts are organic usage and adoption rates by users and especially developers to build applications and services.

What are the Token Incentives? What is the utility of the token (beyond ownership) and how many use cases are practically relevant and included in the token economics How are token owners incentivized to engage in multiple actions on the platform — thereby increasing the extent of the market and its promotion, curation, investment, and more - and hence its usage and token demand.

How Much is a Token Worth?

In assessing the value of a token, think of DAOs in two stages - the adoption phase and the user phase where tokens are held by community participants.

Source: Fundamental Pricing of Utility Tokens, Vincent Danos, Stefania Marcassa, Mathis Oliva and JulienPrat

We are investing in the early phase - the admittedly speculative part where risk is highest - and based on the premise of a large economy (Question 1), potentially driven quickly to decentralization by high existing take-rates (Question 2). Those questions lay out the fundamentals of the market volume and speed - the building blocks for any investment decision.

Combined with a view that there CAN be adoption, assessment of the team and what they are building addresses — WILL there be usage and demand? This depends on the ability of the team to drive the community of both users and developers (Question 3) — requiring a view on Founder Market Fit as with any start-up. Question 4 addresses the token utility - are there multiple use cases? — and the tokenomics — does the protocol provide the right incentives for participation (usage demand) with mechanisms to reduce velocity of supply.

The latter two questions are particularly vital for follow-on funding as part of Conviction Model of investment. Big market potential is table stakes but, as with traditional start-ups, it is all about execution.

Investment Model Basics

No Dilution. We invest early and secure a fixed percentage ownership on a fully diluted basis (FDB). Again it is critical as token supply is fixed and allocated over time as per incentive structures outlined above.

Supply vs FDB. While the FDB percentage should not change, the entire token supply may not even be released (and if so it is over long term). Therefore as usage engeders early demand, the resulting price appreciation may be even greater to the reduced actual amount available for trading.

Form. We invest in both companies (equity with warrants) and DAOs from the get-go. Given the importance of a central team and the migration to community building and decision-making, new economies do not necessarily have to start as a DAO. They often migrate into such a form, starting as company funded by equity (with warrants for tokens) and generate cash flow in fiat until their economy is more mature - with infrastructure, community of users and a functioning economy. Then a native token can be introduced and a DAO established, reflecting the fact that this a gradual process rather than binary.

Liquidity. If all goes as planned and there is sufficient adoption and usage, a public coin offering takes place within 6-18 months. Early investors have some form of lock-up to prevent “dumping” - typically from 6 months to 3 years (released over time) —and after that, there is full liquidity. There is also the ability to buy - which can present opportunities in our model of conviction and involvement.

Valuation

Valuation of DAOs is much different than that of equity. For a company, the price multiplied by the number of shares reflects the valuation of a company as a proxy for the calculation of the NPV of its future cash flows. And an investor must factor in future dilution as start-up financing is inflationary.

For DAOs, token price multiplied by supply represents the potential size of the economy. Price is thus a proxy for demand enabling the token market cap to reach the economy size.

Think of price as a discount to the future potential economic value and reward for token holders to bear the risk and opportunity cost as the economy reaches its potential.

💡 Valuation in the initial stages is directly equated to our 4 questions - how big is the economy and to what extent can this particular platform reach that value through a network of participating users.

DAO Downsides

It likely goes without saying that there are downsides to forming and investing in DAOs, just like any form of start-up equity and even an article like this tends to emphasize only the positive!

Being public before reaching product market fit and widespread adoption can crush token price early and thus hurt a project’s credibility. Plus we are still in the investment stage of most projects so there is heavy correlation on the downside regardless of specific performance or future adoption. For both founders and investors, it can be wasteful and demoralizing to be checking token price every day.

It is also vital to add that not every use case lends itself to being a DAO (or having any form of cyptocurrency). We try to be even-handed and avoid maximalist positions on either side of the spectrum, eg “all crypto is BS” and “every single vertical will move to Web3 and crypto” are not useful for any part of the debate or investment considerations. As mentioned, we are in the very early stages. We are excitingly dipping a toe in this water - while still pursing traditional B2C and Digital SMB deal flow revolving around our core Passionware thesis.

Further Reading: Examples

Protocols. Solana and Ethereum are utilities enabling apps to be built on their blockchains.

What is the use of the coin? The entry ticket for usage.

Ethereum - launched in 2015 at around $1, rose to $10 by 2016 and sat $133 in March 2020. Reached high of $4,800 and still stands at 20x uplift in those 22 months.

Solana - an Ethereum competitor went public in April 2020 at $0.74 and trades at 200x uplift. Its first funding round was done at $0.04 (3,675x)

Gaming. Crypto gaming is expected to reach $100B by 2026. There are many standalone gaming worlds and one of them is Axie Infinity a play-to-earn game similar to Pokémon, but real-life crypto money can be won and used to upgrade your NFT-based fighter, or withdrawn into your personal crypto wallet.

What is the use of a coin? You need some AXS to play the game and it also serves as a governance token

The value of one AXS (the native coin) has gone up 13,496 per cent in the last year.

Metaverse. The Sandbox is an Ethereum-based metaverse and gaming ecosystem where you can create, share, and monetize assets and games.

What is the use of the coin? SAND is used for buying and selling assets on the marketplace, participating in transactions involving land, and to interact with user-generated experiences. It also costs SAND tokens to play games, purchase equipment, or customize your avatar.

At a public launch price $0.008333, recent price of $4.30 is 500X uplift (and token cap of $3.14B). That is just the token, Sandbox as a company also just raised $93M in Series B equity round

Case Study: BOV Investment in Talis

Digital Art meets Physical World

Talis Protocol is an NFT marketplace (like Open Sea) on Terra where artists can sell digital art to consumers and enjoy royalties from secondary sales. In the initial stage there is no native token and all transactions are based on stable coin UST. Ultimately, it will enable Print on Demand (POD) services and connect digital artists to the physical world.

What will be the utility of the token? The token will undergird the POD service — enabling Artists, Customers, and Printing Businesses to freely connect and exchange.

The token will also enable using NFTs for printing rights (exploitable NFTs) as well as DeFi services such as staking, lending and borrowing, fractional NFT ownership and other.

Ownership of the token will provide governance rights, including offering and voting on proposals to improve the network, resolving the misuse of art through Talis’ Artist Justice Court, TaLISA, accepting or rejecting partnerships and launching new projects through the Talis Workshop.

The primary way to acquire TALIS will be by participating in the Talis ecosystem in some form, as well as expected private exchanges.

See our “Why we Invested in Talis” for more on how this investment addressed our 4 questions.

Conclusion and Further Reading

Benson Oak Ventures is at the start of a journey with DAOs. We believe in their disruptive nature in changing the future of how organisations are structured — and how investors can gain early exposure to potentially outsized returns. It is still very early and there is plenty more to learn for us - and for more exciting projects to come our way. Get in touch with me (Robert) or Yoni should you wish to talk DAOs, tokens, Web3 and the future of organisations.

Resources:

Full Digital Oak Blogs:

Part 1 - Passionware and the Web3 Revolution

Part II - Me-Commerce: Everyone is a Business

Part III - The VC Opportunity in Passionware